Right now, you’re in a pretty tight place financially, to say the least. You’re out of work, out of money, and out of ideas.

You know that you need a loan to get by while you search for gainful employment, but how do you even go about getting a loan when you know you’re not going to be able to pay it back?

You might have heard of payday loans, but if you don’t have a job and know what are pay stubs, you’re not going to be eligible for one.

So, what can you do? Can you get a loan without providing a direct deposit pay stub?

In short, the answer yes. In this post, we’ll review what is a pay stub, what does a pay stub look like, and guide you on how to get a loan without one, so you can take back your life.

What Is a Paycheck Stub?

A paycheck stub is, most often, a paper slip you receive attached to your paycheck (or direct deposit receipt) that provides a record of your hours worked, taxes you’ve paid, and the wages you’ve earned both in the pay period (whether it is weekly, bi-weekly, or monthly) and for the entire year-to-date.

While paper pay stubs are still the most common, electronic pay stubs are rising in popularity.

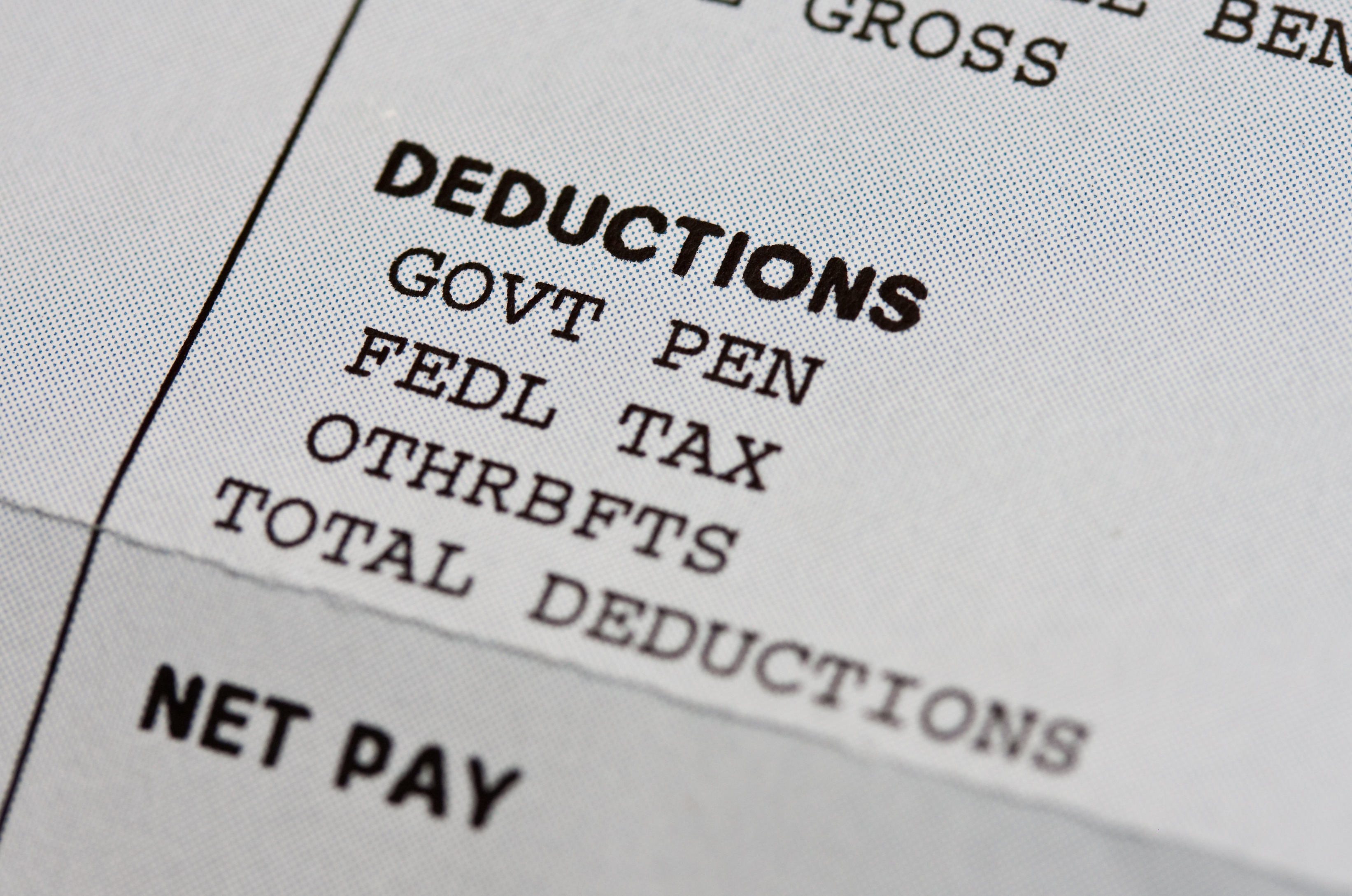

What Does a Pay Stub Look Like?

On your pay stub, you will see the following:

- Your gross wages

- The number of hours you have worked

- A tax breakdown

- Deductions such as health insurance

- Employer contributions to your 401K, if applicable

- Your net (after tax and deduction) pay

- Any PTO you have

You will also see information about your employer and yourself, such as addresses.

How to Get a Loan Without a Paystub

If you need to get a loan while you look for jobs that will actually make you money, there are unfortunately not very many options if you don’t have a pay stub.

Here are a few popular ones:

Car Title Loan

A car title loan is pretty self-explanatory – you provide the title of your car to the lender in exchange for a loan.

The biggest con to a car title loan is that, if for some reason you cannot repay the loan within the terms, you will have to relinquish your car’s title to the lender.

Borrow Using Your Home as Collateral

Borrowing against your home works similarly to a car title loan, only you would be using your home as collateral instead of your car.

In order to qualify, though, you must own your home.

Use a Paystub Maker

If you’re working as a freelancer, consultant, or independent contractor, you won’t get a pay stub from your employer, because you’re the boss!

In this instance, you’ll need to use a paystub maker to generate your own paystubs so you can get a loan.

Be careful with what you use, though, as using a Fake paystub maker and committing income fraud is illegal.

We’ve Answered What Are Pay Stubs

And so many more of your questions.

Now, you won’t have to ask “What are pay stubs?” or worry about figuring out how to get a loan without them.

Want more great financial advice, like how to get out of debt fast?

Check out the rest of our website for that advice and so, so much more.